Two OIA members recently urged members of the Ohio House Insurance Committee to pass legislation that would require health insurers to release certain aggregate claims information to group plan policyholders.

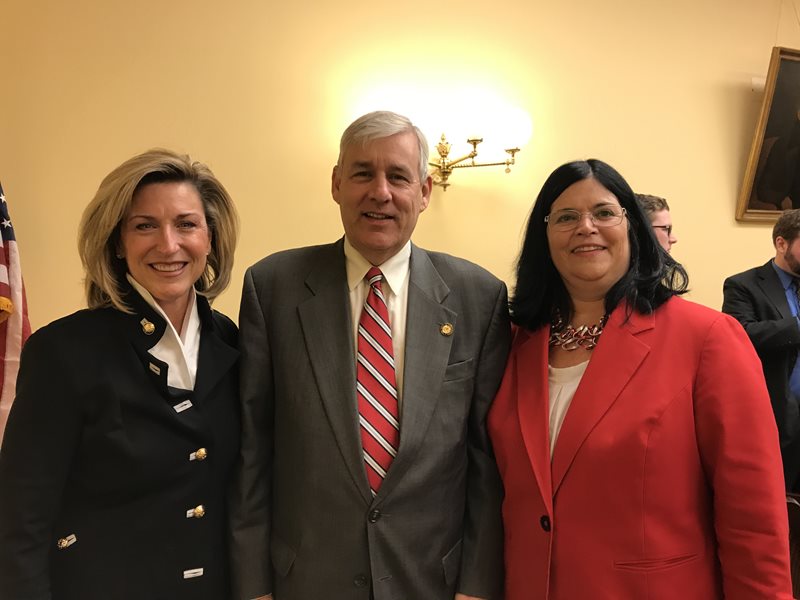

OIA member Victoria McCoy of Associated Insurance Agencies, Inc. (featured in the picture to the left) in Westerville testified in conjunction with OIA’s Government Affairs Manager Carolyn Mangas. Barbara Gerken of First Insurance Group, who is also an OIA member, testified in support of the bill on behalf of the Ohio Association of Health Underwriters (OAHU).

Sponsored by Sen. Matt Huffman (R-Lima), S.B. 227 will provide a solution to a problem that OIA members have brought to our attention over the last several years.

By allowing risk advisors and employers access to claims data, Ohio employers can make better decisions regarding properly assessing health care options to potentially reduce their health care costs.

While this claims data is typically available to employers with 100-plus employees, it is not available to those that fall below this threshold. The lack of this data hinders the ability of risk advisers and employers to pursue additional funding arrangements that have become available in the last several years. While this legislation was originally drafted to apply to all employer groups, it now only applies to those with fifty or more enrolled employees in their group. The rationale for this change was that this range of employees is medically underwritten the same way as the 100+ employer group market.

Ultimately, S.B. 227 would empower risk advisors and employers with the ability to better design a health insurance program that balances the level of risk and reward.

Notably, both Louisiana and Texas have similar laws in place to require health insurers to release claims data.

Several others testified in support of S.B. 227 in addition to OIA and OAHU, including the National Association of Independent Business – Ohio. The only known opponents of the bill include the National Multiple Sclerosis Society, who have cited concerns that employers could identify employees with serious health conditions and discriminate against them.

Prior to receiving hearings in the House Insurance Committee, S.B. 227 passed the Ohio Senate unanimously. With time running short before the end of the legislative session, OIA is advocating for passage of this bill out of the House Insurance Committee. A committee vote is expected to be scheduled for next week. OIA will keep members apprised of developments on this initiative as they occur.

Also see: Ohio Independent Agents Urge Senators To Help Businesses With Health Insurance Options